2024-07-23 01:02:22

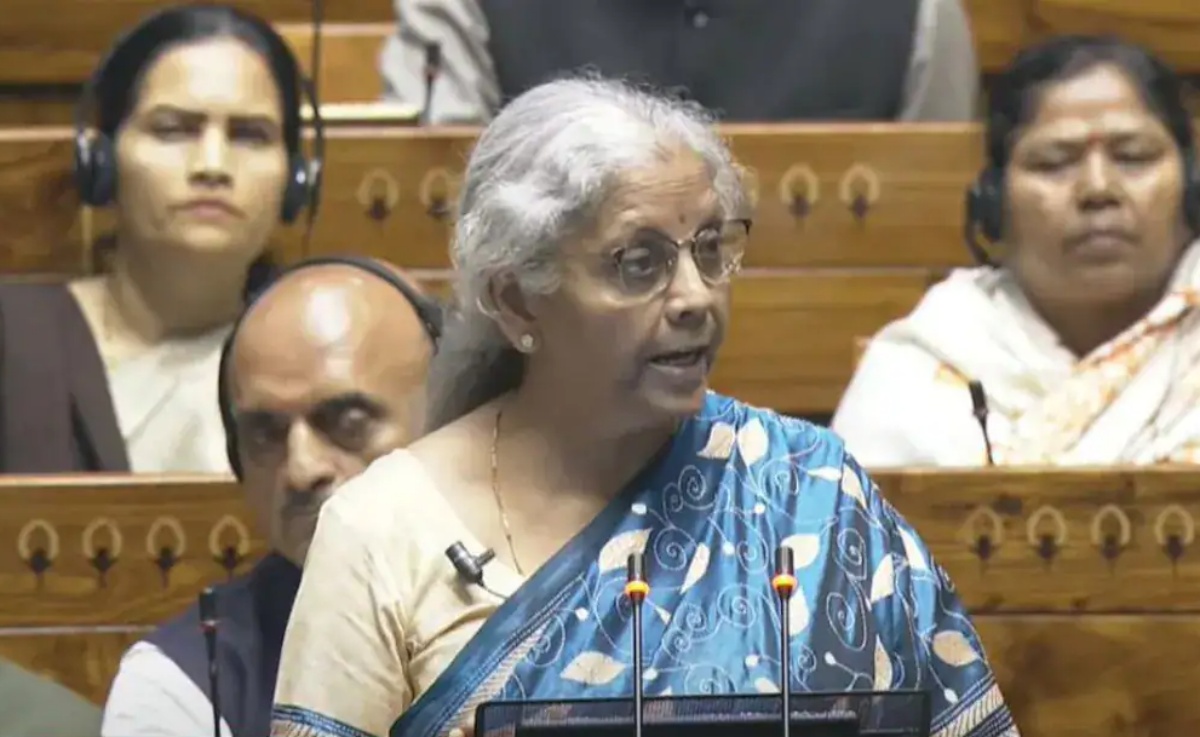

Union Finance Minister Nirmala Sitharaman will present budget today in parliament.

New Delhi:

The full budget for 2024-25, to be presented in Parliament on Tuesday, could possibly increase capital expenditure and may usher in a more standardised approach to taxation, Moody’s Analytics said.

After losing its absolute majority in the lower house, or Lok Sabha, in June, Prime Minister Narendra Modi’s Bharatiya Janata Party will be looking to nurture confidence and public trust in the new coalition government that it now leads, said Aditi Raman, Associate Economist, Moody’s Analytics.

While the interim budget left tax rates on hold, any uptick in planned government spending will need to be accompanied by a higher tax take, either through direct or indirect taxation, to prevent the deficit from widening, she said.

Despite the election shaking up government dynamics, we don’t expect major changes to economic policy in India. This post-election budget will likely reinforce the goals set in the pre-election budget, which emphasised infrastructure spending, support to the manufacturing sector, and fiscal prudence, Ms Raman added.

In the India budget preview, Moody’s Analytics said the budget will have a bearing on business and consumer confidence.

India’s updated union budget will maintain, or quite possibly increase, capital expenditure on infrastructure and funding for production-linked incentive schemes.

The budget will also likely usher in a more standardised approach to taxation, but the broad thrust will be one of policy continuity in the wake of the surprising outcome in this year’s general election, it added.

India is slated to have one of the strongest-growing economies in the Asia-Pacific region in 2024 and 2025. This is primarily due to government spending, rather than domestic consumption or exports, which are important drivers elsewhere in the region, it added.

For a few years now, capital expenditure has played an increasingly important role in powering the economy, chiefly through infrastructure investments.

In February’s interim Union Budget, the government upped its allocation for capex spending by 11.1 per cent to approximately USD 134 billion, or 3.4 per cent of GDP, for the fiscal year to March 2025.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Budget 2024,Budget Taxation,Nirmala Sitharaman

Source link

9 total views , 1 views today