2024-02-02 02:08:13

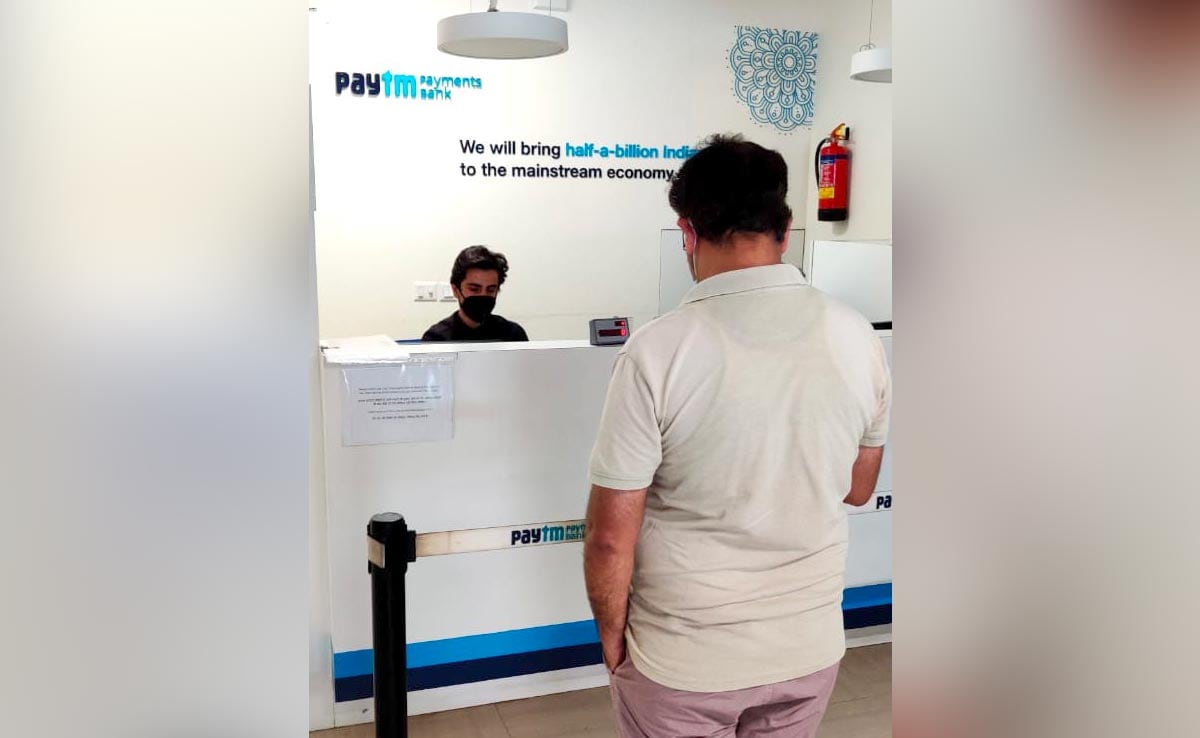

Paytm Payment Bank has been restricted from accepting new deposits or allowing credit transactions

New Delhi:

The Paytm Payments Bank on Friday assured its customers that their “money is safe” with the company, two days after the Reserve Bank of India (RBI) issued a directive restricting it from accepting new deposits or allowing credit transactions after February 29, 2024.

In an email and text message to its customers, the payments bank subsidiary of Paytm said that the RBI directive does not impact their existing balances.

“Your money is safe with the Bank,” the Paytm Payments Bank said in its “important update”.

You Can’t Add Money To Paytm Payments Bank Wallet

The Paytm Payments Bank also told its customers that they will not be able to add/deposit money to their accounts/wallets after February 29.

READ | What RBI Order Means For Paytm And Its Users

“However, there is no restriction on withdrawal of money from your existing balance even after Feb 29, 2024,” it said.

“For any further assistance, please reach out to us via 24×7 help section on the App,” the Paytm Payments Bank told its customers.

RBI’s Clampdown On Paytm Payments Bank

The RBI on Wednesday said that the Paytm Payments Bank cannot take deposits, offer credit services, or facilitate fund transfers from March.

“No further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc. after February 29, 2024, other than any interest, cashbacks, or refunds which may be credited anytime,” the central bank said.

READ | “End Of Paytm Payments Bank, For All Practical Purposes,” Say Analysts

The RBI said it had in March 2022 asked the Paytm Payments Bank to stop adding new customers.

However, a Comprehensive System Audit report and subsequent compliance validation report of the external auditors revealed persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action, the RBI said.

Paytm Shares Drop After RBI Action

Digital payments firm Paytm lost a fifth of its market value on Thursday after the RBI’s action against its associate Paytm Payments Bank.

Paytm’s stock fell to a six-week low of ₹ 609, erasing around $1.2 billion in value from the company.

The stock was down 20%, at the bottom of its exchange-imposed daily trading band.

Paytm on Thursday said it expects a “worst case impact” of Rs 300 crore to Rs 500 crore to its annual earnings from RBI’s order.

The company also said it is taking “immediate steps” to comply with the RBI’s directions and that it expects to “continue on its trajectory” to improve its profitability.

Paytm Payments Bank,Paytm,Paytm news,Paytm shares news,Paytm shares,Paytm stocks,Paytm stock

Source link

![]()